Effects

While there is no doubt that many of the choices made helped Fonoa get to product-market-fit for individual products earlier, it was also clear that there were trade-offs.

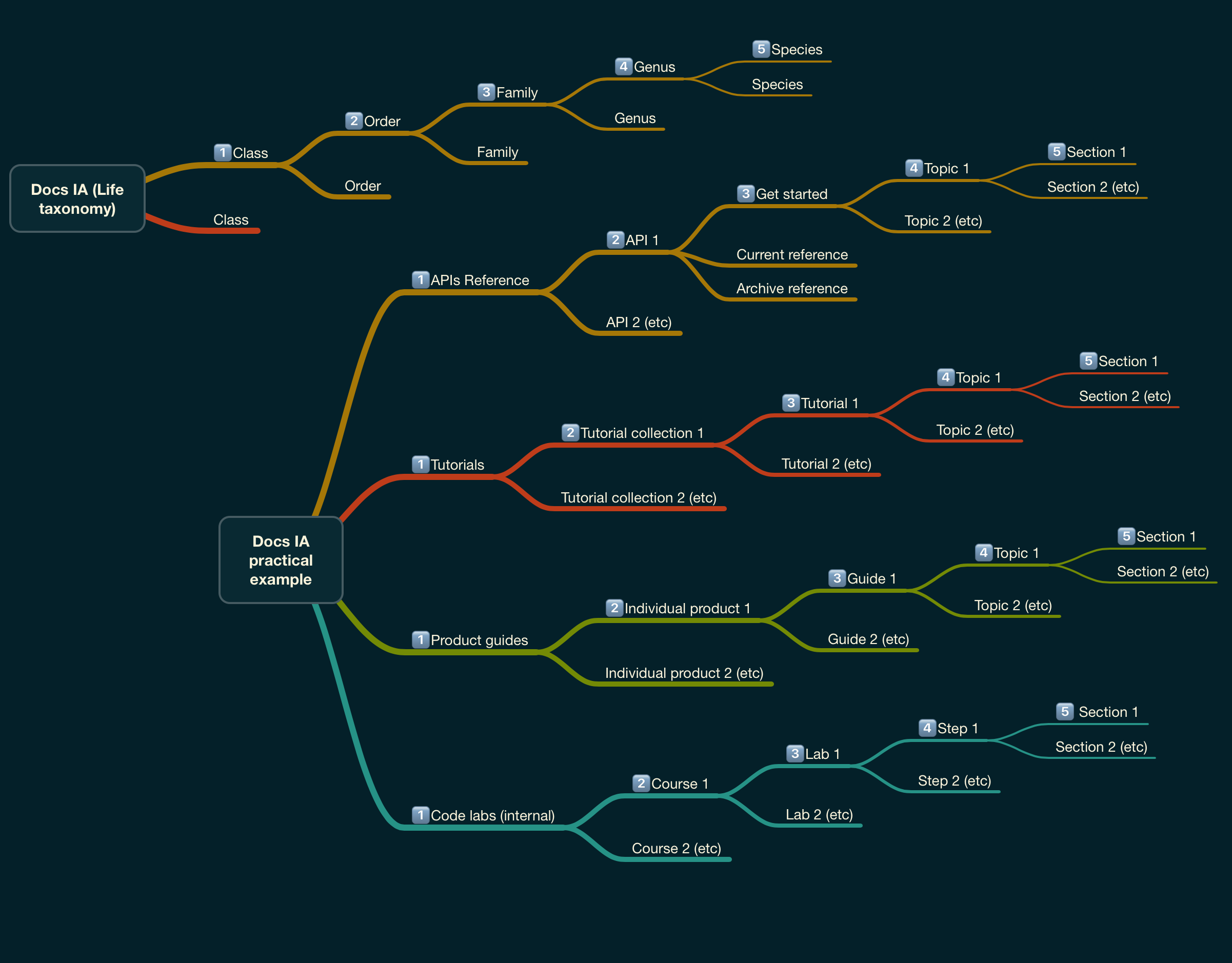

Fonoa's products are used by tax and finance teams within medium to large size enterprises. These teams are cost centres, which unlike revenue generating teams, invariably do not have standing engineering resources to conduct API integrations. While each of Fonoa's products offer conceptually simple APIs to integrate with, the challenge becomes more about providing the Fonoa APIs with the right data and then processing the response. Given that each product has a separate client facing API, the effort to integrate multiple products increases linearly with minimal integration economies available.

Having performed basic integrations, each client must themselves manage the orchestration of data between Fonoa's products as the response from one product will either be a trigger or an input parameter for another. In addition should the client wish to introduce any conditional logic within their processing then this is on the client to either build or connect up an appropriate workflow engine.

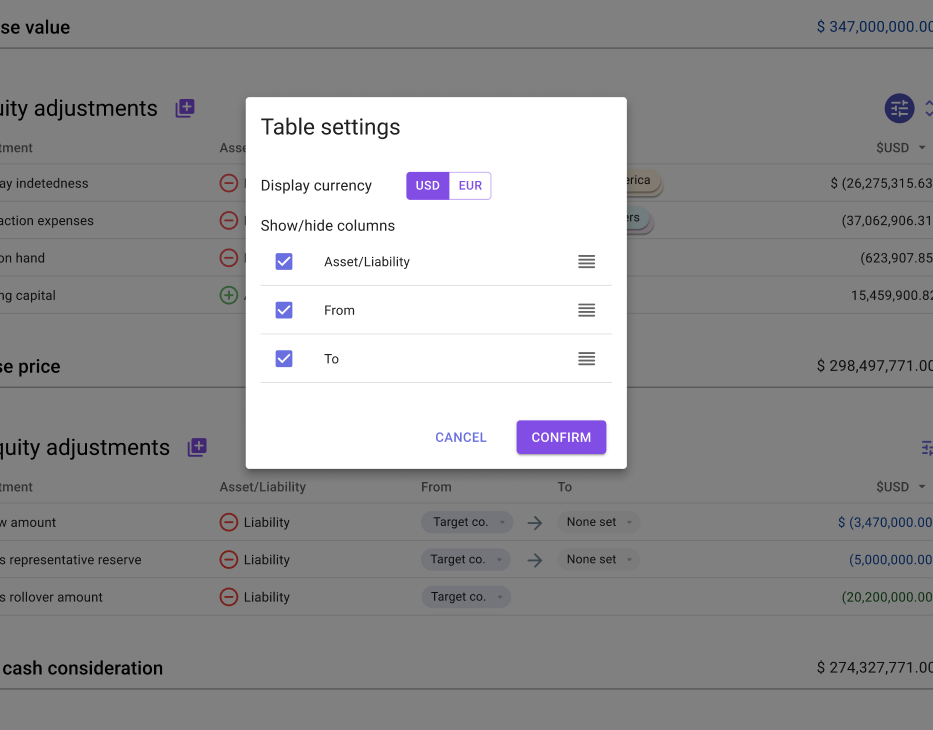

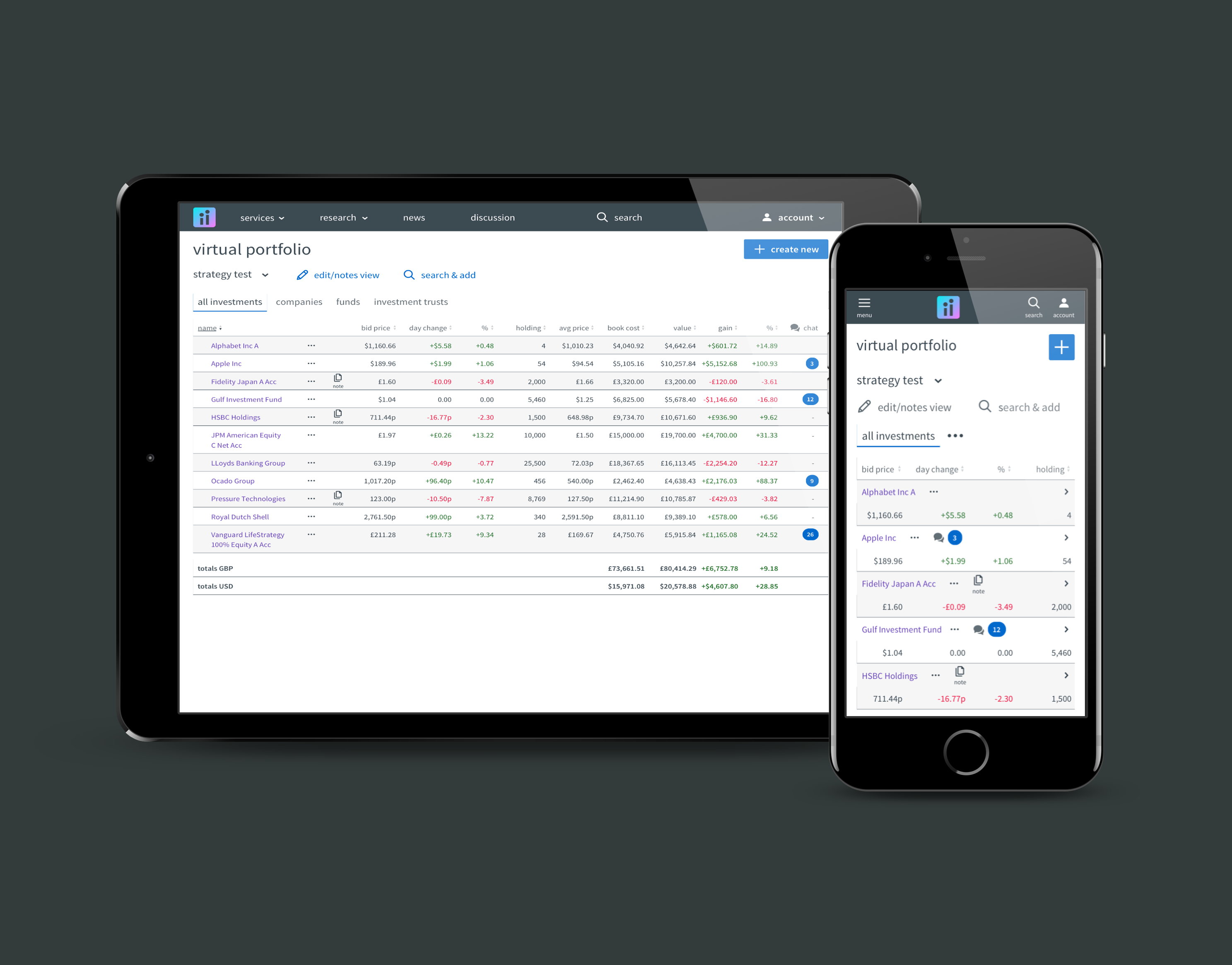

On the UX side while Fonoa does provide a unified operations dashboard app, in practice the only unification across products is a single-sign-in and common design system. Each product occupies a separate space within the app. Each also has an individual approach to data naming (due to API inconsistencies), content hierarchy and interaction patterns. However most troubling from a strategic point of view is that the app provides little value-add to users beyond displaying lists and details for individual operations. In effect the product experience is that of a basic calculator which performs well but does not provide any insights or top-down outcome awareness from the data in aggregate.

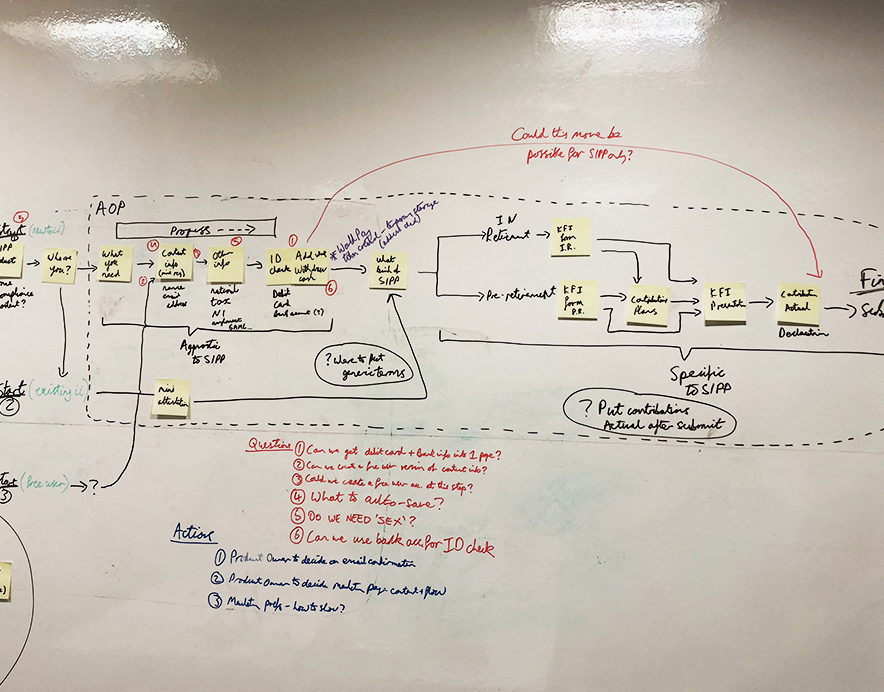

A further facet of Fonoa's proposition is ongoing client service. Given the users are not technical and the considerable data throughput, there is an ongoing need to provide client support and data intervention processes across the products. As is common, the client service team at Fonoa operates horizontally across products. The team were very vocal in explaining their frustrations at having next to no self-service tooling and instead needing to log directly into separate cloud db admin consoles to troubleshoot issues. In all cases if an action was required then a request ticket to engineering would need to be logged. At the level of a single product this was not ideal but manageable. However task management and ultimately serving clients across multiple products was riddled with inefficiency.

The net result of effects across product, UX and CX stands was that our revenue team struggled to cross sell our products. Given the high levels of incumbent market penetration and the long sales cycles our ability to get early adopters to take multiple products was key to achieving our revenue targets. Beyond the cross-sell difficulty there was also the top-of-funnel problem of increasing deal flow outside of tech-first platforms that we had had early success with. To get broader appeal within more traditional enterprise, we needed to both make integration easier and open up a pathway for integration partnerships with the big 4 consultancies that most of our ICP prospects were deeply embedded with.